Essential characteristics for fostering financial hub: transparency, equity, and stability

Ho Chi Minh City (HCM City), the economic powerhouse of Vietnam, is set to transform into a regional hub for finance, technology, logistics, education, and creative industries by the end of 2025. The city, after its merger, boasts geographical advantages that can help it achieve this ambitious goal.

The biggest challenge in linking institutions, infrastructure, and urban development in HCM City is the lack of connectivity and coherence. To address this issue, the city needs to re-plan its focus areas for each sector. For instance, the seaport system could be relocated and concentrated in the Cái Mép area to improve efficiency and connectivity.

The government's vision for HCM City and Đà Nẵng includes the development of International Financial Centres (IFC). To make this a reality, city management needs to be entirely digitised. Proposed policy includes fully digitising all administrative procedures and databases, ensuring synchronous operation among agencies for predictable task completion times.

Transparency, fairness, and stability are the most important criteria for a regional financial centre from an international financier's perspective. To attract 'anchor tenants', positioning policies that compete regionally and attract reputable international investors are more critical than infrastructure. Policies for HCM City's IFC should be liberal and competitive with other regional hubs to achieve success.

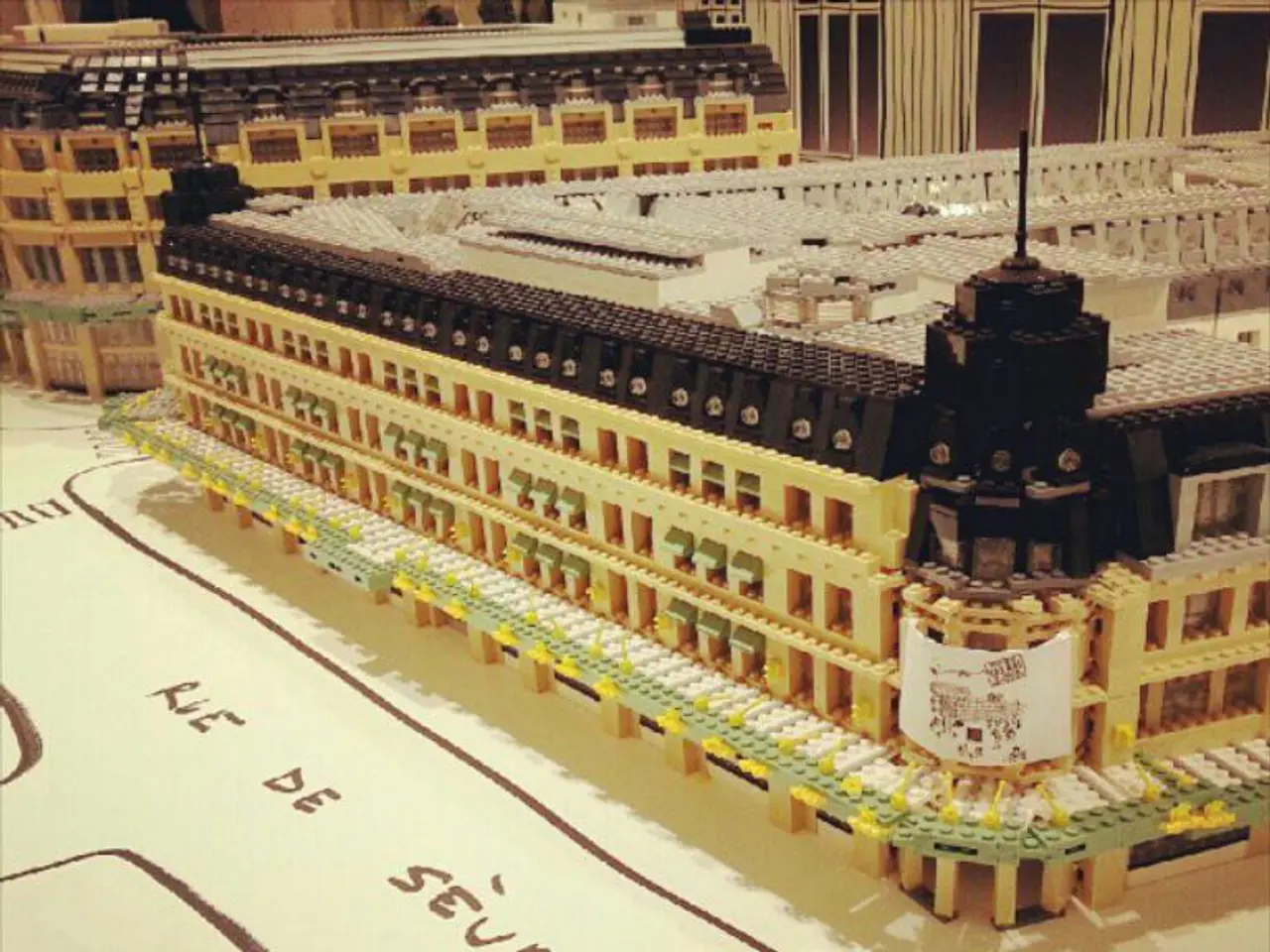

The optimal development model of each financial centre depends on its geographical location. Thủ Thiêm, expected to be the 'Pudong of HCM City', has lagged in progress. However, it's important to remember that the core of a financial centre lies in policies and mechanisms, not just undeveloped land.

Some multinational enterprises are already using Vietnam as a regional business management center for the ASEAN market and even the Asia-Pacific region. Foreign investors engage with the IFC to better access the Vietnamese market, not for business activities in other countries. In fact, foreign investors may establish additional offices in the HCM City IFC due to significant policy differences that allow them to conduct business activities unavailable elsewhere, yielding financially appealing results.

The expansion of urban space is a crucial prerequisite for HCM City to develop key sectors like finance, technology, and logistics. To gain anchor tenants, conditions typically include offering attractive, suitable premises, meeting specific company requirements, and often requiring that the tenant establish their main or secondary business location there. The greater risk is weak execution capacity, as opposed to lacking a breakthrough model or having excessive expectations.

In conclusion, HCM City's journey towards becoming a regional financial hub is well underway. With the right policies, infrastructure, and execution, the city has the potential to become a significant player in the Asian financial landscape.

Read also:

- Naloxone dispensers installed at five train stations in Cook County Health and CTA initiative

- Transitioning to Environmental Profitability

- Maruti Suzuki bolsters growth trajectory through GST benefits, Victores launch, and safety improvements focus

- Building Association of Solingen Engaged in Savings and Construction Projects